Did you know a tiny 1% price increase can boost operating profit by nearly 11%, according to Harvard Business Review?

It’s a remarkable figure that highlights a simple yet often overlooked truth: smart pricing can have a dramatic effect on your profit. Yet raising prices indiscriminately doesn’t work. Generating real value means getting to the heart of what customers truly care about—then building (and pricing) those features they’re willing to pay for.

The Product Focus article on pricing and Journal on pricing highlight many key aspects—yet one element often remains underexplored: Willingness to Pay (WTP).

In this blog, we explain what WTP is, why it’s so important, how to measure it, and how to apply it to product and pricing decisions. Whether you’re a seasoned product manager or just starting to grapple with pricing strategies, understanding WTP will help you create offerings that reflect genuine customer value.

1. What Is Willingness to Pay?

Willingness to Pay is the highest price a customer is ready to spend on a product or feature. It’s not about exploiting customers; it’s about ensuring you don’t undercharge or overbuild. Many companies guess at pricing or rely on gut instincts. We’ve seen time and time again that this approach leads to missed opportunities. By uncovering what people will truly pay, you can optimize revenue without alienating your audience.

2. Why Does WTP Matter?

Grounds Pricing in Reality: WTP helps you avoid pricing solely based on cost or competitor benchmarks. Instead, it aligns your offering with the exact value customers see in it.

Shapes Product Decisions: You gain insight into the features or benefits that command the most value. This data allows you to invest in what matters and avoid bloat.

Informs Market Segmentation: Not all customers share the same budget or value perception. WTP can guide how you segment your audience and tailor tiers or bundles.

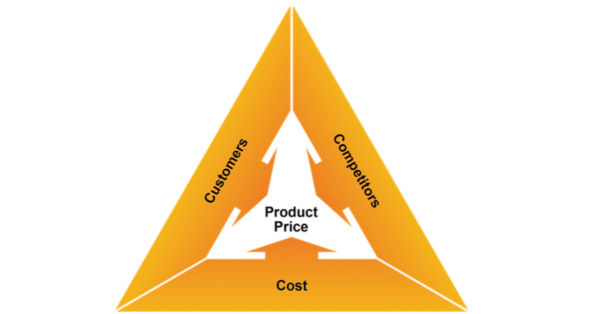

Figure 1: The main constraints on pricing

3. How to Measure WTP

There isn’t a perfect way to measure Willingness to Pay. Different methods shine in different situations. Below are some common approaches, along with guidance on when to use them, their relative complexity, and the insights they offer.

Customer Interviews and Surveys

When It’s Best:

-

- Early in the product lifecycle, when you’re still refining your value proposition.

- When you need qualitative feedback on pain points, motivations, and perceived value.

How It Works:

-

- You ask open-ended questions about e.g., how much customers might pay, which features they consider essential, and what they value most.

- Follow up with targeted prompts about trade-offs and priorities.

Complexity and Insights:

-

- Complexity: Low. Can be conducted via one-on-one interviews or online questionnaires.

- Insights: Rich qualitative data on why customers value certain features, but be cautious—customers might over- or understate their true willingness to pay.

A note on Jobs To Be Done and Kano Analysis:

Jobs to Be Done: By discovering from customers what “job” they hire your product to do, you’ll learn the real outcomes they seek. Aligning these outcomes with pricing ensures you’re charging for tangible results—an excellent tie-in with WTP.

Kano Analysis: During interviews, customers could classify features as e.g., must-have, valued, exciters. With some analysis, this helps you zero in on which features directly impact customer satisfaction and, in turn, their willingness to pay.

Van Westendorp’s Price Sensitivity Meter

When It’s Best:

-

- If you’re looking for a relatively quick, broad-strokes understanding of an acceptable price range.

- For simpler products without too many feature variants.

How It Works:

-

- Customers indicate at which price points they consider a product too cheap, cheap, expensive, and too expensive.

- You plot these responses to find an optimal pricing range and price point.

Complexity and Insights:

-

- Complexity: Moderate. You’ll need to collect enough data from a representative sample to see meaningful patterns.

- Insights: Gives you clear thresholds of what’s acceptable. However, it doesn’t dig deep into feature trade-offs.

Figure 2: Van Westendorp’s Price Sensitivity Meter – output

Conjoint Analysis

When It’s Best:

-

- If your product has multiple features or versions and you want to pinpoint which features drive willingness to pay.

- When you have enough time and resources for a more data-heavy approach.

How It Works:

-

- Customers evaluate different product configurations, each with its own mix of features and prices.

- Statistical modeling then reveals how much each feature influences the final choice—and at what price.

Complexity and Insights:

-

- Complexity: High. Conjoint studies require careful design and statistical analysis, often with specialized tools.

- Insights: Detailed breakdown of which features have the strongest impact on WTP. Excellent for prioritizing product roadmaps or creating tiered bundles.

A/B Testing

When It’s Best:

-

- If you already have a live product or website with sufficient traffic to run experiments.

- When you want to observe actual purchase behavior rather than rely on hypothetical responses.

How It Works:

-

- Split your audience into groups and expose each to different price points or feature bundles.

- Track conversions, revenue, and engagement across variations.

Complexity and Insights:

-

- Complexity: Medium to high. You’ll need proper traffic volume and a strong setup to ensure valid test results.

- Insights: Real-world data on which version customers truly pay for. Minimizes guesswork and self-reported bias.

Each method brings its own advantages and trade-offs. If you’re at an early stage without a product in market, Interviews or Van Westendorp might be more accessible. When your offering is complex or feature-rich, Conjoint Analysis may help. And if you already have solid web traffic and a functioning product, A/B testing provides highly reliable insights based on actual customer actions.

By selecting the right tool for the right situation—and sometimes mixing multiple tools—you’ll get a clearer picture of your customers’ willingness to pay. This becomes the foundation for decisions that resonate with your audience and support long-term business growth.

4. Common Pitfalls to Avoid

Relying on One Opinion: One person’s feedback shouldn’t dictate price. Combine quantitative and qualitative sources.

Ignoring Customer Segments: If you only look at averages, you miss how different groups perceive value.

Forgetting the Competitive Environment: Customers are aware of alternatives. Consider their perception of competitor offerings.

Staying Static: WTP can shift as markets and needs evolve. Revisit your data from time to time.

5. Real-world Example: Zendesk’s Outcome-Based Pricing Approach

Consider Zendesk’s innovative approach to pricing their AI-powered customer service platform. Instead of charging a flat fee for their AI capabilities, they’ve moved to an outcome-based model where customers only pay for successful automated resolutions. Why? Because their customers don’t buy AI features—they buy successful customer service outcomes.

This means if the AI successfully resolves a customer issue end-to-end, you pay for that resolution. If it doesn’t, you don’t. When business leaders can directly tie costs to successful outcomes, the decision becomes much easier. The pricing perfectly reflects the value delivered, while eliminating the risk of paying for technology that doesn’t deliver results.

6. WTP as a Fundamental Design Principle

WTP isn’t just about numbers—it can guide you from discovery all the way to launch (and beyond). Here’s how:

Discovery and Validation

-

- In early research, ask customers about pain points and how much solving them is worth.

- Let these conversations shape your product and feature set.

Product Development

-

- Use WTP data to prioritize features with the highest perceived value.

- Avoid feature bloat by focusing on what people want and are willing to pay for.

Pricing Strategy

-

- Align your tiers, bundles, and overall price points with the WTP insights gathered.

- Ensure each plan resonates with a particular segment’s needs.

Go-to-market Launch and Iteration

-

- Post-launch metrics indicate whether your prices align with reality.

- Adjust quickly if you see churn or low adoption at a specific tier.

In-life Expansion and Growth

-

- Revisit WTP as you introduce new features or enter new markets.

- Keep your pulse on shifting customer preferences to maintain optimal pricing.

Figure 3: Pricing should be considered throughout the Product Management Lifecycle

WTP threads through each step because it centers on delivering genuine value. When you build with the willingness-to-pay mindset, you save time, resources, and avoid creating features that aren’t wanted—or worse, that are wanted but under-priced.

7. Practical Tips for Getting Started

Combine Multiple Data Points: Don’t rely on one survey or a single focus group. Look for consistency across different methods. If you have different customer segments, don’t forget that they’ll have different needs and value things differently—and will probably have a different willingness to pay.

Engage Colleagues: Sales, Customer Success, and Finance have a wealth of insights. They hear customer objections, feedback, and what they really use and value first-hand.

Document Everything: Keep records of your pricing experiments, interview notes, and test results. This fosters a culture of evidence-based decision-making.

Revisit Regularly: Markets change, and so does your product. Plan periodic reviews of your WTP data to stay aligned with evolving customer needs.

8. Final Thoughts

Willingness to Pay isn’t just about numbers. It’s about understanding customers’ perceptions and aligning your product with the true value they see in it. By adding WTP to your pricing skillset, you’ll make more informed decisions that satisfy customers and support your product goals.

Learn more about designing products around the price in Monetizing Innovation: How Smart Companies Design the Product Around the Price from Madhavan Ramanujam and Georg Tacke.

Join the conversation - 4 replies

Thought booster article

We’re glad you enjoyed the read!

Thank you for this enlightening blog on willingness to pay! It really helped clarify how understanding customer perceptions and behaviors can drive more effective pricing strategies. The concepts shared will definitely influence how we approach pricing decisions moving forward.

We’re happy you found this blog helpful!🙂