Let’s talk about discovery

In this blog, you’ll gain insights into the highs and lows of product discovery, learning from the mistakes of notable companies. We’ll guide you through practical methodologies and tools to uncover market problems and develop viable solutions. Whether you’re a product manager, entrepreneur, or business strategist, this blog will equip you with the knowledge to navigate the complexities of discovery and innovation effectively.

The Rise and Fall of Juicero: A Case Study in Innovation

In 2016, Juicero burst onto the scene with a grand vision to shake up the health-drink game for good. Picture this: a sleek, $699 juicer that could connect to your Wi-Fi, promising to transform ordinary produce into extraordinary fresh healthy drinks. But wait, there’s more! They later slashed the price to $499, making it a tad more accessible. Here’s the catch: to unlock the juicer’s magic, you needed fancy fresh “produce packs,” priced between $4 and $10 each. It’s like the inkjet printers or coffee-pod machines of the health world—you buy the machine, then keep stocking up on the consumables.

And the machine? It wasn’t just any old juicer. It was engineered to perfection, with a design so meticulous it would make even Steve Jobs proud. Founder Doug Evans didn’t just want a juicer; he wanted a statement piece. The machine was capable of wielding almost four tons of pressure, which Evans proudly compared to two Teslas. With Wi-Fi connectivity and a QR code reader to ensure your produce was fresher than a daisy, this juicer was the epitome of modernity.

Too Reliant on Wi-Fi

But, and here’s where the plot thickens. This juicer had a bit of a Wi-Fi addiction. Yes, you read that right. It refused to work without a steady Wi-Fi connection, which turned out to be a big downfall. Despite its dazzling features, Juicero found itself struggling to stay afloat in the business world. Matters were made worse in April 2017 when they experienced a PR disaster. Two Bloomberg journalists published a story and a video titled, “Do You Need a $400 Juicer?” The video showed that you didn’t really need four tons of pressure to extract the juice from the pack. It was a beautifully engineered solution to a problem that didn’t exist. Eighteen months after launch, Juicero shut down operations in September 2017. This was a well-funded company with smart people trying to do their best… but things just didn’t work out.

The Complexity of Discovery: Even Market Giants are Susceptible

Consider three renowned companies that ventured into product innovation but stumbled along the way, showcasing the difficulty of discovery.

- Amazon Fire Phone: Boasted impressive 3D effects but failed to capture the market, leading to its demise within a year.

- Microsoft Zune: Though promising, arrived too late in the game and couldn’t compete with the iPod’s dominance.

- Nokia N-Gage: Nokia faltered with a product that didn’t quite fit as either a games console or a phone.

The lesson here is crystal clear: no company is immune to the pitfalls and difficulty of innovation. It’s a sobering reminder that we must exercise diligence to avoid stumbling into similar traps.

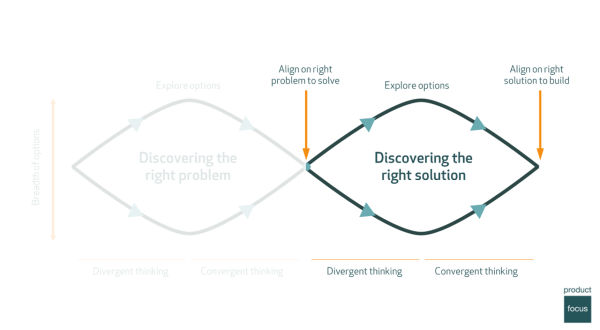

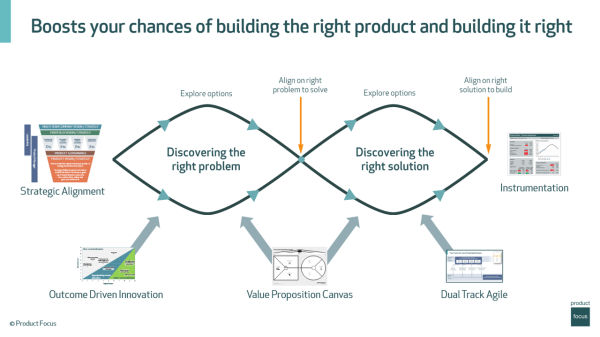

Understanding Discovery: A Methodical Approach

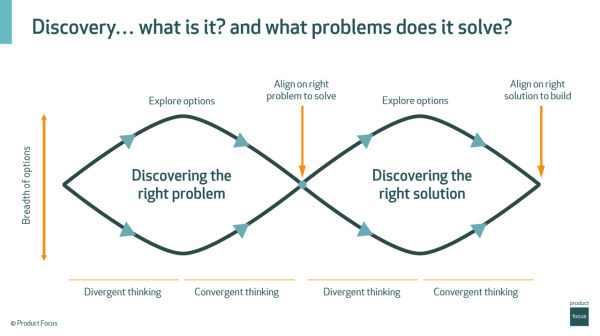

Discovery involves a systematic process to uncover and validate both market problems and potential solutions. The double diamond approach (see the ‘Double Diamond’ diagram below) helps navigate this journey:

Discovering the Right Problem to solve (left diamond)

- Diverge: Explore a wide range of potential problems.

- Converge: Narrow down to the most promising issues.

Discovering the Right Solution to build (right diamond)

- Diverge: Generate potential solutions.

- Converge: Select the best solutions through testing and experimentation.

Discovery allows you to methodically find the right solution to the right problem.

Diagram: The ‘Double Diamond’ of Product Discovery

We’ll look at some approaches to help in this process, but it’s essential to address two prerequisites beforehand, which we’ll look at next.

Prerequisite 1: In-depth domain knowledge

The first prerequisite for effective discovery is the foundation of good domain knowledge. This means having a thorough grasp of your company’s problem domain, as solid Discovery hinges upon this understanding.

You may need to consider:

📊 What is the current market size, and how is it projected to grow?

💥 What emerging trends or disruptions could impact the market?

🧩 What regulatory, technological, or economic factors could influence the industry?

♟️What strategies are competitors employing?

Why is it important? Without a solid understanding of the domain, distinguishing valuable insights from interesting ‘noise’ becomes challenging.

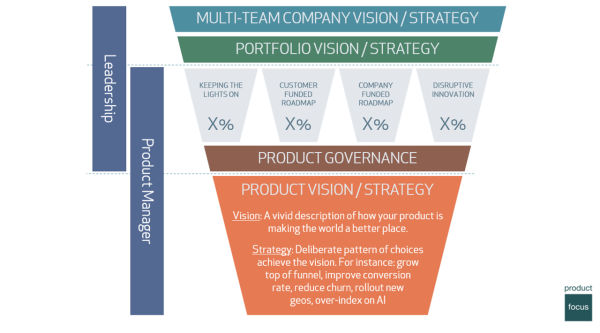

Prerequisite 2: Strategic alignment

The second prerequisite is aligning your discovery with your company’s goals. Even a worthy problem and solution won’t matter if they don’t align with your company’s strategy and direction.

In multi-team companies, consider the strategy cascade: a top-level vision flows into a portfolio vision, which then breaks down into different strategic pillars or investment buckets. Finally, it leads to your product vision and strategy. Your discovery process must align with this cascade to ensure it supports the company’s overall direction.

Diagram: Use the strategy cascade to align your discovery activities with company vision and strategy

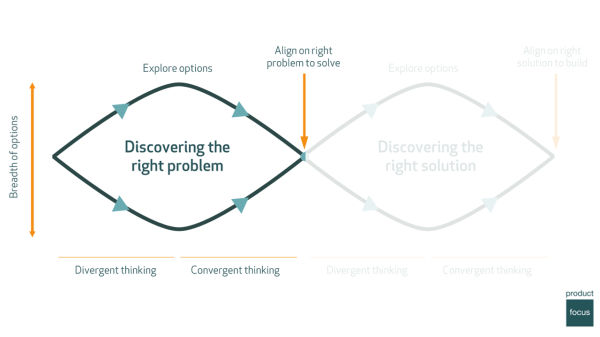

Discovering the right problem

Diagram: discovering the right problem to solve is critical – it needs to be aligned to your domain of expertise and company strategy.

We often face a dilemma: what users want isn’t always what they need. Imagine it’s 2004, and you’re doing market research in a video rental store. Customers would probably ask for reduced late fees, longer rentals, and a wider selection. While helpful, these are just incremental improvements.

Fast forward a bit, and streaming services revolutionized the industry. Focusing solely on what users said they wanted would’ve missed this shift entirely. This example shows the importance of looking beyond immediate requests to understand deeper needs and broader trends.

Remember: Users’ actions speak louder than words – quality insight will lead to better discovery.

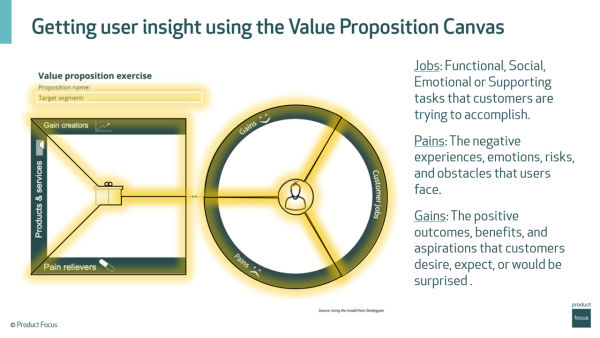

Using the Value Proposition Canvas during problem discovery

Strategizer came up with an approach to gather and organize user insights with the Value Proposition Canvas (see diagram). To effectively use the canvas, there are a few steps – we’ll simplify here:

- Target Segment: First things first, be super clear about your target segment. Narrowing down your focus ensures your findings are precise and actionable.

- Observe Users: Next, observe your users instead of just asking them directly what they want. Watch their tasks / jobs, noting their gains and pains. For example, if someone cycles to work, a gain might be avoiding car use, while a pain could be arriving tired due to a long, hilly route.

- Create Ideas: Understanding these details allows you to think of solutions that enhance their gains and reduce their pains. This method ensures your insights are grounded in real user behavior and needs.

Diagram: The Value Proposition Canvas from Strategyzer can be used for visually organizing customer jobs, pains and gains.

Applying the value proposition to our real-life example

Let’s use the marketplace for gas engineers as an example to apply this approach. Let’s say there is an app, and the app can help gas engineers. It does a great job. It streamlines appointment bookings, groups jobs geographically to reduce travel, and cuts down on paperwork. Great starting points, but what’s next?

First, identify all customer jobs involved in running a gas engineer business: e.g., finding customers, delivering services, sending invoices, and staying updated on regulations.

- Observe Users and their Jobs: Spend a day with a gas engineer. See the full cycle of their work, from fetching tools to traveling and performing services. Make observations and ask them about their experiences – good and bad.

- Identify Pains and Gains: Through observations and discussions, identify their pains (e.g., long travel times, complex paperwork) and gains (e.g., efficient booking, reduced admin work).

- Cluster Feedback: Group the insights into clusters of common problems. For example, difficulties with regulations, managing customer expectations, or optimizing travel routes.

- Value Proposition Canvas: Use this tool to map out the customer jobs, pains, and gains. It helps in understanding deeper needs and identifying areas for innovation.

The Jobs-to-be-done (JTBD) Approach

This approach can also help us to identify core jobs, such as maintaining an efficient schedule or ensuring regulatory compliance. We can break these down into specific outcomes like minimizing travel time, ensuring paperwork is always up-to-date, or having reliable reminders for regulatory changes.

By understanding and addressing specific jobs and outcomes, we can enhance our product in ways that truly meet the needs of gas engineers, beyond just what they initially say they want. For more details on these methods, refer to the book “Value Proposition Design” by Strategizer, which provides deeper insights into the value proposition canvas, or explore the jobs-to-be-done framework by Anthony Ulwick’s Strategyn. Both are excellent resources for diving deeper into customer needs and driving innovation.

Prioritizing which problems to solve

One approach to prioritize which problems to solve is:

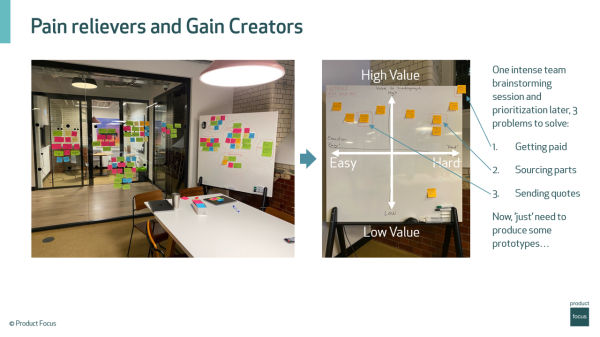

- Cluster the main problems: For example, we have clusters in our example around getting paid, sourcing parts, sending quotes; we know which are the most promising, as we know which provide the biggest gains or remove the biggest pains for our gas engineers.

- Plot the outcomes on a chart: With difficulty of implementation on the horizontal axis and value to the customer on the vertical axis. This chart is great to stimulate discussion with your teams – it divides problems into distinct areas, providing clear insights into where your opportunities could lie and associated value versus difficulty.

Diagram: Segmenting your problems – plotting execution difficulty against value to customers provides a great visualization and discussion tool for teams.

Using Outcome Driven innovation during problem discovery

Outcome Driven Innovation (ODI) is an approach to innovation created by Anthony Ulwick of Strategyn. It focuses on understanding and fulfilling the specific outcomes that customers desire when using a product or service. Unlike traditional innovation methods that might prioritize features or technologies, ODI prioritizes the “jobs” customers want to accomplish and the outcomes they seek from those jobs.

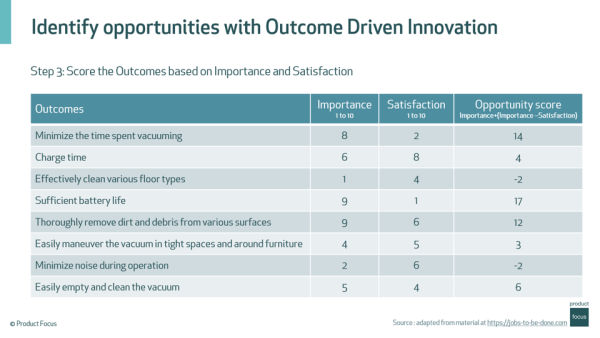

Let’s take a hypothetical example for a vacuum cleaner – and how we might prioritise innovations around particular outcomes:

1: Define the Job to be Done (JTBD)

- Maintain a clean and hygienic home

2: Identify outcomes

- Minimize the time spent vacuuming

- Charge time (always ready)

- Effectively clean various floor types

- Sufficient battery life

- Thoroughly remove dirt and debris from various surfaces

- Easily maneuver the vacuum in tight spaces and around furniture

- Minimize noise during operation

- Easily empty and clean the vacuum

3: Score the Outcomes based on the job importance and customer satisfaction with existing solutions

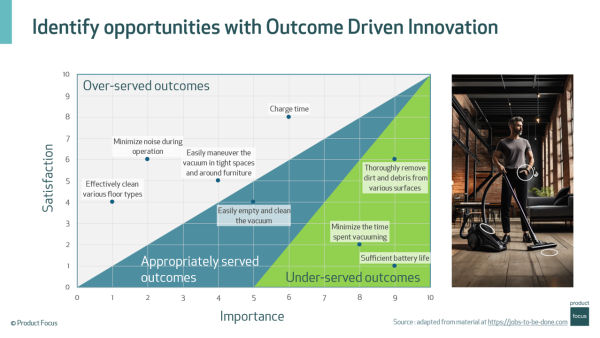

4: Plot the outcomes against satisfaction and importance

The idea here is to choose to solve problems around under-served outcomes: they have relatively high importance to customers and existing solutions are delivering low satisfaction.

Discovering the Right Solution

Diagram: discovering the right solution – there are often many different solutions to a problem.

Once you’ve settled on the right problem to solve, then we need to explore options to discover the right solution to the right problem.

Using the Value Proposition Canvas during solution discovery

As we move into discovering the right solution to offer, the Value Proposition Canvas is also helpful. We have already identified jobs, pains and gains in the right half of the canvas. We now turn our focus to generating ideas for products and services that have a good fit for customers.

Check for a good fit

- Products & Services Enable Jobs: Make sure your ideas for products and services help customers perform their important jobs effectively.

- Pain Relievers Match Pains: Ensure that the pain relievers you identified match the specific pains of your customer segment.

- Gain Creators Match Gains: Ensure that the gain creators align with the specific gains your customer segment desires.

Validate Assumptions

Test your hypotheses about customer pains, gains, and jobs through market research, customer interviews, and feedback. This step ensures that your understanding of the customer is accurate and that your value proposition is truly compelling.

Iterate and Improve

Based on feedback and validation, refine both your view of the customer segment and profile, and what they truly value. Continuous iteration helps in better aligning your value proposition with customer needs and improving your product-market fit.

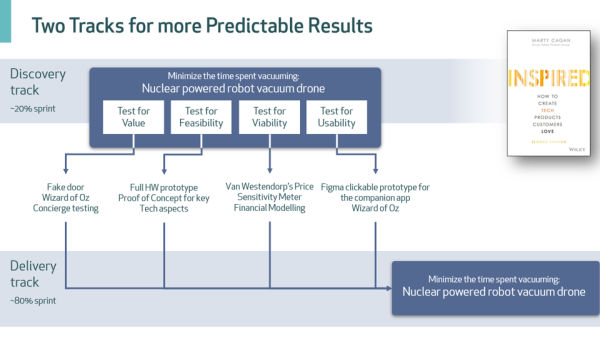

The Concept of Dual-Track Agile

Dual-Track Agile is a framework proposed by Marty Cagan in his book “Inspired”. It helps teams deliver the right product effectively and efficiently by dividing the work into two concurrent tracks: Discovery and Delivery. Each track has a distinct focus and set of activities, but they run simultaneously and are closely integrated.

The discovery track focuses on uncommitted work, aiming to validate whether a new idea is worth pursuing.”

There are four key tests to satisfy in this process. The first test is to determine if the solution is valuable to customers. While the problem might be validated, it’s crucial to ensure that the proposed solution effectively addresses the gap. Several methods can be used to test this without fully building the solution, such as the Wizard of Oz, concierge testing, or the fake door approach.

Test for value

For example, if a large supermarket chain is considering an expansion into travel services, a user journey on the website featuring travel offers could be created. By monitoring user interactions with this new content, interest can be gauged, and the potential value of the service can be validated before fully developing it.

If people are not interested in travel, no matter how good the proposition is, they will not follow the user journey. It is essential to understand if the idea resonates with customers, which is how value is tested. One method to test for value is the fake door approach, but many others exist.

Test for feasibility

The next step is to test for feasibility. The engineering team assesses how challenging it is to implement the idea. This often involves creating a prototype or a proof of concept, especially for the more complex aspects of the solution. A discovery track can help address situations where engineering consistently takes longer than expected.

Test for viability

Once value and feasibility are established, the next focus is on business viability. This involves understanding how much customers are willing to pay, using methods like the Van Westendorp price sensitivity meter. By determining the perceived value, potential pricing, and estimated costs, a business case or financial model can be developed to evaluate the idea’s potential success.

Test for usability

The final test is for usability. Assuming the product has value, people are willing to pay for it, and it can be built, the question remains: can users use it effectively? Usability testing ensures that the product is user-friendly and functional. This can be done through various prototyping methods to confirm that users can navigate and utilize the product as intended.

Key Takeaways for Successful Discovery

Successful product discovery is a critical yet challenging aspect of innovation. It requires a deep understanding of customer needs, market dynamics, and potential solutions. Many teams struggle with this phase, often due to a lack of clear direction, insufficient research, or misalignment with business objectives. However, by following a thoughtful and structured process, you can significantly improve your chances of success:

1. Alignment with Company Strategy:

Research and discovery efforts must align with the overall company strategy. The domain of research should be in line with the company’s goals and objectives.

2. Discovering the Right Problem and Solution:

The process involves identifying the right problem to solve and the appropriate solution.

-

- Outcome-Driven Innovation: This approach involves asking customers about the outcomes they desire, and their relative importance and satisfaction with existing solutions.

- Value Proposition Canvas: This tool helps break down customer jobs and fully understanding their pains and gains. By focusing on ways to elevate gains and reduce pains, it guides the ideation process toward finding a valuable solution.

3. Dual-Track Agile:

Dual-Track Agile, from Marty Cagan’s “Inspired,” divides product development into Discovery and Delivery tracks, running concurrently to ensure efficient and effective product creation.

-

- Discovery Track: Focuses on validating new ideas before development, using methods like the Wizard of Oz, concierge testing, or the fake door approach to test value.

Four Key Tests:

-

- Value: Ensuring the solution addresses customer needs.

- Feasibility: Assessing technical implementation challenges through prototypes.

- Viability: Evaluating business viability and customer willingness to pay.

- Usability: Confirming the product is user-friendly through usability testing.

This approach helps teams deliver products that are valuable, feasible, viable, and user-friendly.

4. Instrumentation for Post-Launch Evaluation:

Discovery doesn’t end at launch. During the design phase, plan for metrics and telemetry to evaluate the product’s performance after it goes live. This can include:

- User Engagement: How users interact with the product.

- Customer Satisfaction: How satisfied customers are with the product.

- Business Performance: How the product contributes to business goals.

- Technical Performance: How well the product performs technically.

- Proper instrumentation and a ready dashboard are crucial for tracking these metrics effectively.

Diagram: there are several helpful tools to boost your chances of solving valuable customer problems and building the right product.

This blog covers some key approaches from the webinar delivered by Cyril Le Roux, a Product Focus Senior Consultant. He has over 20 years of product management experience, mainly across Telecoms, eCommerce, Marketplaces (in real estate, trades, and print on demand), and FinTech.

Don’t forget to register for free, to receive access to the Product Focus Toolbox – an online curated library of world class resources for product managers: whitepapers, infographics, journals, and more…

Leave a comment