Business cases are a complete waste of time. You know that the numbers will be wrong and made to say whatever it takes to get sign-off. When being first-to-market really counts – business cases just slow you down.

Whilst we don’t believe this we’ve certainly seen this attitude in the past!

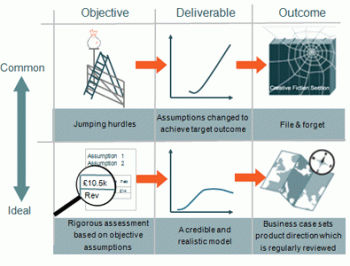

This diagram compares different approaches to developing business cases – which one do you take?

When you’ve been living and breathing your product for months, even years – you’re entirely bought into the value of its continued development. But while all babies are beautiful to their parents not all babies are beautiful.

The real value of a business case for a company is that it enforces discipline and structure around making investment decisions. The great opportunity for a product manager is that it allows time for a thorough and rigorous analysis of their product and its market with the full support of the rest of the business.

The value of this analysis is often at odds with other drivers. The product manager’s key motivation can be to make sure their product passes through the business case stage as smoothly as possible. The business rewards product managers that tell them about good investment ideas. This creates a problem in that what the business wants to hear and what the business needs to hear aren’t always the same thing.

Product managers know that only good investments get the green light but it’s equally important for the business to know that a particular idea is not a good investment.

Creating the right culture to produce an objective assessment during the business case is vital. This is often achieved through a healthy tension between an evangelizing product manager and a skeptical finance representative. But companies ought to be able to trust product management to provide an unbiased view of opportunities.

Does your business foster a culture in product management where an objective view is really rewarded? How many product managers have been recognized positively after producing a business case that shows that their product should be stopped?

See our infographic here for the topics to cover and the tools that can help.

Ian Lunn

Director, Product Focus

Join the conversation - 4 replies

Oh boy, how many times have we seen the numbers of business cases (which are usually assumptions multiplied by hunches) tweaked to match a target?

Even better if you have a dodgy strategy model or framework to fiddle with.

Great stuff, keep it up!

I can recall one business case I worked on over 6 months that assessed the creation of a new product through acquiring an existing vendor in the market. All of the financials met the typically acceptable metrics of revenue, profitability, growth, target customers, addressable market, route to market capacity etc. In the end we did not go ahead with this business case because late into the six month assessment there was a spate of law suits issued between each of the established market players. As a larger company with deeper pockets the company followed my recommendation and simply walked away to avoid becoming the law suit magnet in the market. My point being that business cases based on financials alone do not address the equallt important job of identifying and quantifying the risk of pursuing the business.

I totally agree with you. A Business Case should not only involve financials, but everything related to the business. This includes lawsuits and the general legal situation, stakeholders, strategic fit… maybe a Balanced Scorecard system for a business case made sense?

This is basically about a conflict of interest. Very true, though.

I hope you do not mind that will link to this post from my blog http://inspiredproductmanager.wordpress.com .